In preparation for the new customs procedures that will take effect when the UK leaves the EU, C4T has identified three different flows that will be supported by HMRC for the arrival of goods into the UK and we have incorporated them into CAS.

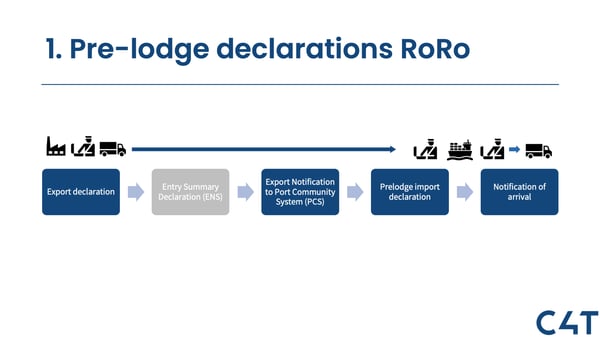

1. Pre-lodge. As soon as the goods are released on the continent, CAS can pre-lodge your declaration. CAS produces the export declaration and notifies the Port Community System to declare the goods in the UK long before they arrive. The pre-lodge import declaration is automatically sent before arrival at the port of entry. Provided no inspection is requested, your truck can simply drive off the ship in the UK with all formalities in place. Note: Entry Summary Declaration (ENS) is not foreseen in this flow as it has been postponed by HMRC. If the port is inventory linked, you will need to get a badge from a Port Community System provider in the UK.

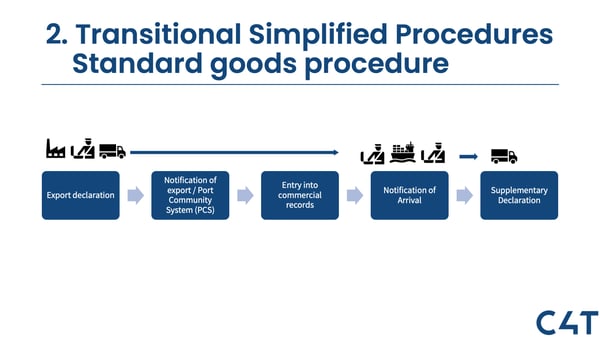

Note: Supplementary declarations can be delayed until October 4, 2019.

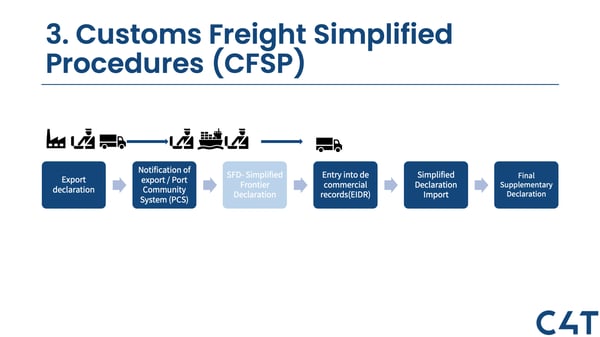

3. Customs Freight Simplified Procedure (CFSP). This customs flow is very similar to TSP, however you will need to obtain a CFSP authorisation from HMRC in order to use it. As with the other flows, CAS will create the export declaration and notify the Port Community System. CAS lodges entry into the declarant´s records when the goods arrive in the UK, then triggers the supplementary declaration as well as a final supplementary declaration to be sent at the end of each month.

Note: Simplified Frontier Declaration step is not foreseen in this flow.

At C4T, we have a laser-like focus on getting our customers prepared for Brexit. These customs flows, along with the introduction of fast onboarding and our single message, multiple filing feature are just another step towards streamlining your trade with the UK once Brexit hits.