Customs Special Procedures allow suspending, paying less or paying no duty on imported or exported goods. While these cost-saving customs and excise authorisations are universal, they may be known by different names in different countries globally. The main universal Special Procedures are Customs Warehousing or Bonded Warehousing, Inward Processing (IP), and Outward Processing (OP).

In this post, we’ll explore the benefits of inward processing and how it works, along with how it is integrated into CAS, our automated customs software solution.

What is Inward Processing?

Inward processing is a duty relief procedure designed to give businesses the possibility to process goods imported from outside the EU customs territory, even before deciding on whether to sell the finished products within or outside of the EU. Inward Processing also applies to goods which require standard forms of handling to preserve them, improve their marketable quality, or prepare them for distribution. The processed products under this procedure can either be re-exported or released to free circulation in the EU without incurring additional duties.

Inward Processing also applies to goods which require standard forms of handling to preserve them, improve their marketable quality, or prepare them for distribution.

An example of Inward Processing

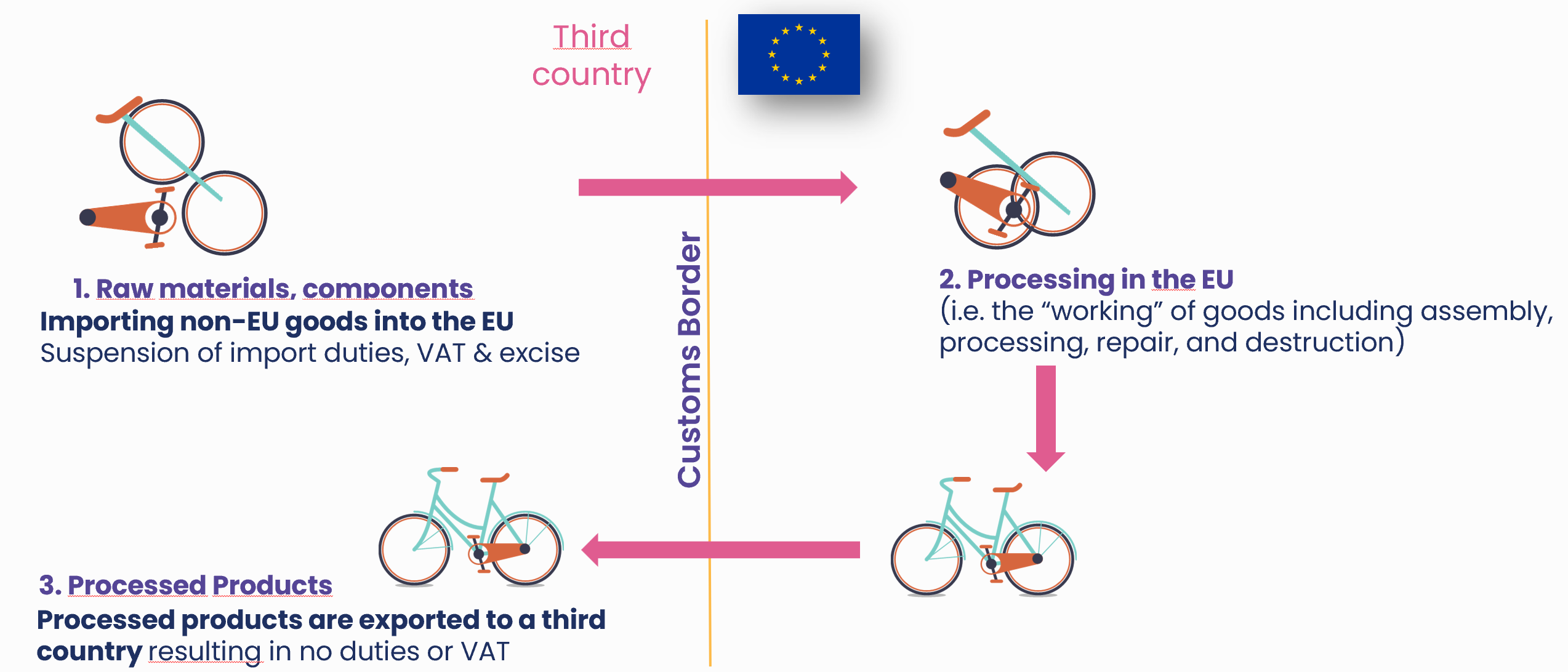

To illustrate the mechanism of Inward Processing, we often use the example of importing parts of a bike, processing them to a full working bike, and consequently exporting this bike. It results in significant savings for companies that source raw materials globally to make products for export.

What are the differences between Inward Processing and Outward Processing?

Inward processing allows goods to be imported into a customs territory for manufacturing, repair, or processing without paying import duties, as long as the finished products are later exported. Outward processing is the opposite, letting goods be temporarily exported for processing or repair abroad, with reduced or no duty applied when they return. The main difference lies in the direction of movement and where the processing takes place, inside or outside the customs area.

Benefits of Inward Processing

When imported under Inward Processing, these goods are not subject to:

- Import duty: Inward processing allows businesses to import goods into the European Union (EU) for processing without having to pay import duties and VAT upfront. This can result in significant cost savings, especially for businesses dealing with high-value goods.

- Other taxes related to their import, such as VAT and/or excises: By deferring the payment of import duties and VAT until the processed products are released to free circulation or re-exported, companies can improve their cash flow and allocate resources more efficiently.

- Commercial policy measures: Inward processing facilitates participation in global value chains. Companies can source raw materials or semi-finished products from different parts of the world, process them within the EU, and then distribute the finished products both within the EU and internationally.

Under Inward Processing, the concerned business can apply to pay duty at the rate and customs value applicable to the imported goods at the time of acceptance of their customs declaration. Otherwise, the duty and import VAT will be calculated according to the rate and customs value of the processed products at the time they are released for free circulation, which typically is significantly higher. The deferment of duties results in a massive cashflow advantage for businesses.

How Does Inward Processing Work?

Inward Processing allows businesses to import parts or raw materials from outside the EU, process or assemble them into finished products, and then export those products without paying import duties or VAT. This procedure supports manufacturers that rely on imported components for goods intended for markets outside the EU. When the goods enter under Inward Processing, they remain under customs control until the process is completed.

Businesses must obtain authorisation from customs authorities before using this procedure. The authorisation defines which goods can be used, the processing operations allowed, and the discharge period for completing and reporting the activities. Once processing is finished, the resulting products can be re-exported, released into free circulation in the EU, or stored under customs warehousing or in a free zone.

The authorisation may also permit the use of equivalent Union goods, such as using EU-produced sugar instead of imported sugar to make biscuits. Under this system, the finished products can be exported either before or after the importation of the equivalent non-Union goods.

At the end of each discharge period, the company must submit a Bill of Discharge to customs authorities. This document accounts for all imported goods, details the processing operations, and confirms how the goods were discharged, ensuring compliance and maintaining the duty suspension benefits of the Inward Processing procedure.

How to apply for Inward Processing?

- Check eligibility

Your business must be established in the EU, maintain accurate records, and provide a financial guarantee to cover potential customs debt. - Apply for authorisation

Submit your application through the EU Customs Trader Portal or your national customs system. Include details on the goods, processing operations, discharge period, and expected yield. - Customs review

Customs authorities assess your application, may inspect your facilities, and verify that your administrative and control systems meet the requirements before granting approval.

For more details, see the European Commission’s guidance.

How long is an authorisation for Inward Processing valid?

An authorisation for Inward Processing is generally valid for up to five years. In some cases, customs authorities may grant a shorter period, especially when the goods are considered sensitive, the operations are limited in scope, or the authorisation is simplified and covers a single import. When the authorisation expires, businesses can apply for renewal if their procedures and compliance record meet customs requirements.

The Complexities of Inward Processing

The benefits of using Inward Processing are quite clear, so “what’s the catch”?

As mentioned before, the first prerequisite for businesses to use Inward Processing is obtaining the correct authorisation from customs authorities. Beyond this, the procedure demands detailed administrative control over all goods involved. Every step must be documented, from the moment goods are placed under the procedure until their discharge. This includes recording storage locations, processing operations, subcontracting activities, and any transfers between sites. Accurate record-keeping is essential, as customs may audit these records to verify compliance and ensure that no customs duties or VAT were avoided improperly.

At the end of each discharge period, the business must submit a Bill of Discharge summarising all goods imported, processed, and discharged. This document confirms that the company has met its obligations and that all goods under Inward Processing have been properly accounted for.

Because Inward Processing involves strict procedural rules and complex record requirements, many customs brokers lack the expertise to manage it effectively. As a result, businesses often need to build in-house customs knowledge or hire specialised staff to handle the procedure correctly and avoid compliance risks.

Looking for an Inward Processing software?

Customs4trade’s software solution, CAS, enables clients to seamlessly keep records on all goods held under Inward Processing. From automatically creating stock records based on the inbound declaration to keeping track of all kinds of movements afterwards, all required administration is housed in the Special Procedures module. The system also knows when a discharge period is due and automatically generates a Bill of Discharge. Read our whitepaper on Inward Processing now.

To accommodate this, and more, there are several functionalities included in the CAS Special Procedures module.

Stock View

Here, the user can find an overview of all items held under a special procedure with their respective balance at any moment in time.

A stock record forms the basis for customs reporting and includes all data needed for keeping stock balance and calculating customs debt. It also holds elements for write-off rules and links to the related customs declaration information. The records provide full visibility of all stock movements in the respective storage location(s). As such, stock records are key for customs authorities during customs controls and audits.

Movement View

In a similar fashion, the movement view provides an overview of all customs movement transactions for a certain item or product at any moment in time. Examples of such movements are stock adjustments, scrappings, and transfers.

Material Lists and Formulas

Through the use of material lists and formulas, CAS knows instantly what stock needs to be decreased and when a processed product is being released into free circulation or re-exported under Inward Processing. The material list and formulas define which materials will be processed as well as what products will be created out of these materials.

Depending on the user’s needs, the related stock is written off FIFO or by specific write-off rules.

In addition to the pre-defined material lists in the system, CAS can also create material lists automatically at the time of an outbound shipment.

The bottom line: there is no need for painstaking administration to start processing goods under Inward Processing when you’re using CAS.

Are you ready to take advantage of the benefits of the Inward Processing Special Procedure?

Book a demo meeting with one of our specialists!